The Summary of the Corporate Bond Report 2018 by Deloitte Group

Corporate bonds are current on the top of the priority list for investors when considering investment decisions. According to the latest research by the Deloitte Group, the corporate bond category of investments is the fourth highest allocated asset class in Australia. It is ranked below property, cash and shares. In this report, I summarise the findings of the Deloitte Report.

Why are holding corporate bonds getting more common in the Australian market? The most common reasons are that corporate bonds offer a reliable income stream, preserve capital and play an essential role in diversifying the risk of a portfolio. This is, especially important for the above 55-year bracket as they start to build investment portfolios for their retirement.

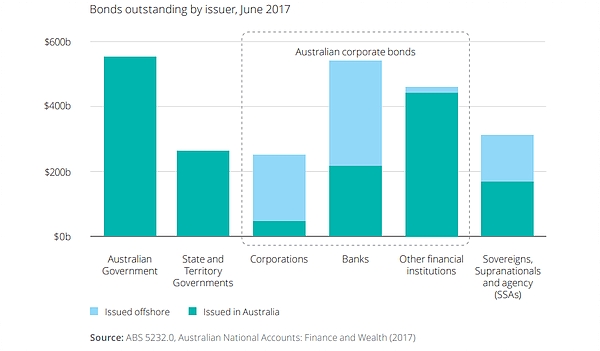

Furthermore, the current low-interest rate environment has stimulated further demand for corporate bonds as they offer a sustainable higher return than other investments. This scenario is, especially important to those accumulating wealth and for high-net-worth individuals (HNWI) whose incomes are mainly based on their investments. In most of the scenarios, bonds are traded in the professional over the counter market in parcel amounts around $500,000 or more. The recent changes to corporate regulations allow investors to invest as little as $10,000 per parcel. The new regulation has helped the market to grow more than 40% since 2010. With the figure updates till June 2017, total bonds on the issue by Australian banks were around $540 billion, another $460 billion on the issue by the other financial institutions and $255 billion by non-financial corporate companies. The full diagram of bonds outstanding by issuers shown as follows:

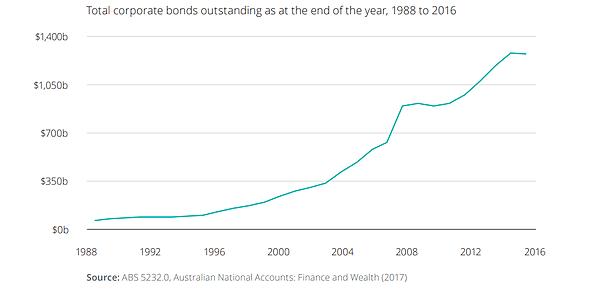

In recent years, the innovative funding solutions have enabled unrated companies to issue bonds. The tighter corporate lending conditions in the Australian banking sector such as stricter reporting standards and stronger balance sheet or cash flow requirements have driven the demand for these new funding solutions. Therefore, this brings up an apparent potential growth of issuing bonds in the Australia market.

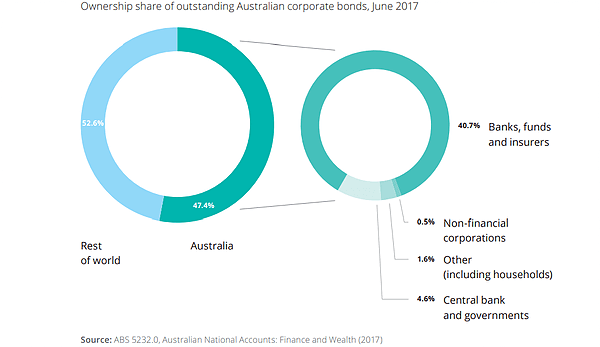

When investors observe in a boarder overview of the world’s bond market, 47% of Australian corporate bond market owned by the Australian investors, while the remaining held by the overseas investors shown as follows:

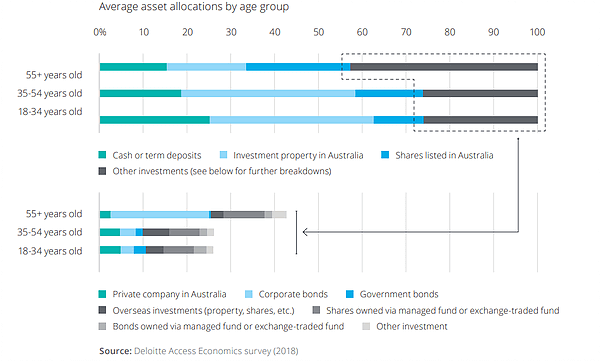

The Organisation for Economic Co-operation and Development (OECD) has stated the asset allocations in bonds and bills for Australians are below the average of 40%. The figures have shown that this market still has a high potential for growth for the upcoming years. This is because Australia’s corporate bond market is relatively underdeveloped and market participation is relatively low compared to the other countries. An interesting fact is the HNWI segments in Australia have significantly more substantial holdings of corporate bonds if they are in retirement or near retirement age, especially in the age group of 55 years old or older. The diagram below shown in full details:

Under the Deloitte Access Economics survey 2018, the figures clearly show that the age group of 55 or more years old hold more than a triple amount of corporate bonds than the group of 35-54 years old and the group of 18-34 years old in average. Those two age groups are more commonly focus on investment properties in Australia. The primary barrier caused to invest in corporate bonds is because of the lack of awareness of the benefits of the bonds market. There is almost 70% of non-investors have insufficient understanding of corporate bonds. Without the knowledge of bonds, how can the Australia investors have the confidence to purchase bonds for long-term investment? This leads to 84% of high net worth individuals in Australia do not own corporate bonds.

Instead of investing in properties or shares in the Australian market, the corporate bond market is another excellent option for investors to consider with the average gross return of 6.1% last year. Probis Securities Group is here to help. Our team of wealth management experts strive to be at the forefront of the industry to ensure all of our clients receive the right solutions, especially in bonds investment and portfolio management. Talk to us today by giving us a call or email us for any further inquiries. For the full Deloitte report, please click on the link as follows:

https://fiig.com.au/docs/default-source/publications/the-corporate-bond-report-2018-final.pdf

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818

AFSL 338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively

as “Probis Group”). It is a general communication being provided for informational purposes only. It is

educational in nature and not designed to be taken as advice or a recommendation for any specific

investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment

from Probis Group to participate in any of the transactions mentioned herein.

Probis Group provides

general financial product advice only. As a result, this communication, and any information, has been

provided by Probis Group without taking account of your objectives, financial situation and needs.

Probis Group’s Australian Financial Services Licences do not authorise it to provide personal

advice.

Before acting on any information in this communication, you should consider the

appropriateness of it (and any relevant product) having regard to your circumstances and, if a current

offer document is available, read the offer document before acquiring products named in this

communication. You should also seek independent financial, legal and taxation advice if any investment

mentioned herein is believed to be suitable to your personal goals.

Investors should ensure that

they obtain all available relevant information before making any investment. Any forecasts, figures,

opinions or investment techniques and strategies set out are for information purposes only, based on

certain assumptions and current market conditions and are subject to change without prior notice. Any

examples used are generic, hypothetical and for illustration purposes only.

Probis Group believes

that the information contained in this communication is correct and that any estimates, opinions or

conclusions are reasonably held or made as at the time of compilation. However, no warranty is made as

to the accuracy or reliability of this information (which may change without notice). Probis Group

relies on third parties to provide certain information and is not responsible for its accuracy, nor is

Probis Group liable for any loss arising from a person relying on information provided by third

parties.

Investment involves risks, the value of investments and the income from them may fluctuate

in accordance with market conditions and taxation agreements and investors may not get back the full

amount invested. Both past performance and yields are not a reliable indicator of current and future

results.