Rolling New Issues Macquarie Group Limited

In Australia, the market for corporate debt continues to grow rapidly. Just like IPO’s in the equity market, the trading of new issues of corporate bonds is becoming a more popular investment strategy for traders. In this article, we discuss a plan for trading new issues that often yields excellent returns with limited exposure.

Companies can raise capital from different options, such as borrowing, finding additional private investors, or being acquired by another company. However, the IPO option by far raises the largest sums of money for most companies, especially public companies who can usually enjoy lower interest rates when they issue debt. Initial Public Offering can also increase the company’s exposure, prestige and public image, which helps to improve the company’s sales and profit.

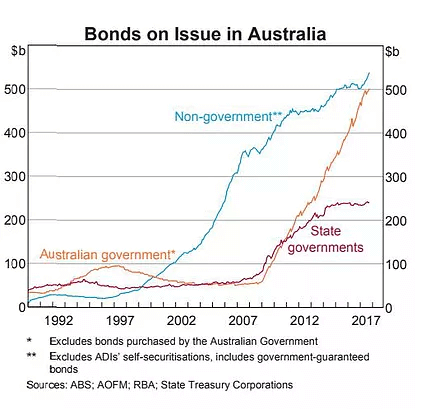

The diagram of RBA 2017 figures on issued bonds, continue to support the popularity of this market. The value of non-government bonds issued in Australia has increased to a record level to $520 billion.

Bonds remain as a central part of any investment portfolio diversification because bonds have shown the ability to weather both political and economic volatility as such they make an excellent contribution to any self-managed super fund. Investors seeking a stable or defensive portfolio with recurring income and low risk should consider corporate bonds. However, those looking for quick returns can also invest in Bonds or notes. The strategy is similar to the IPO market in equities. When a new listing comes on that is well sort after the share tends to float at a premium. Investors grab this premium for a quick profit. Likewise in the bond markets, a well sort after bond can float at a premium. Initial investors can take advantage of this for a quick return.

As an Example

Macquarie Group has reported stellar profit results delivering the net profit of $2.56 billion. It has superior earnings from each of the five core divisions, including the asset management, corporate and asset finance, banking and financial services, commodities and global market and Macquarie Capital. The asset management contains the highest proportion - 33% of the total net profit contribution.

Even Macquarie Group has some earnings exposure to volatile capital markets conditions. However, the group has sustainable profit from the latest financial year, which is a positive signal to the potential bond investors. The group intends to raise capital by issuing a Convertible Note. Due to the running yield, the group’s credit rating, the success of the previous note the issue will be well sorted after by investors. Thus it is expected to float at a premium. It is this premium that short-term investors are looking into. For example, the note will be issued at face value of $100. As anticipated once it hit the market it may trade to $102, it is this $2 that is the premium, which investors may roll out off once it is floated in the secondary market. This is an easy gain to any bond portfolio of 2%.

Macquarie Capital Notes 3

- First call in December 2024

- Expected Margin of 400-420bps over three months BBSW

- “Rollover“ issue from the existing MQGPAs Capital notes which called on 7th of June 2018

- Based on an approximate 90-day BBSW of 2.02%, this equates to an indicative initial distribution rate of between 6.02% to 6.22% inclusive of franking.

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818

AFSL 338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively

as “Probis Group”). It is a general communication being provided for informational purposes only. It is

educational in nature and not designed to be taken as advice or a recommendation for any specific

investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment

from Probis Group to participate in any of the transactions mentioned herein.

Probis Group provides general financial product advice only. As a result, this communication, and any

information, has been provided by Probis Group without taking account of your objectives, financial

situation and needs. Probis Group’s Australian Financial Services Licences do not authorise it to

provide personal advice.

Before acting on any information in this communication, you should consider the appropriateness of it

(and any relevant product) having regard to your circumstances and, if a current offer document is

available, read the offer document before acquiring products named in this communication. You should

also seek independent financial, legal and taxation advice if any investment mentioned herein is

believed to be suitable to your personal goals.

Investors should ensure that they obtain all available relevant information before making any

investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for

information purposes only, based on certain assumptions and current market conditions and are subject to

change without prior notice. Any examples used are generic, hypothetical and for illustration purposes

only.

Probis Group believes that the information contained in this communication is correct and that any

estimates, opinions or conclusions are reasonably held or made as at the time of compilation. However,

no warranty is made as to the accuracy or reliability of this information (which may change without

notice). Probis Group relies on third parties to provide certain information and is not responsible for

its accuracy, nor is Probis Group liable for any loss arising from a person relying on information

provided by third parties.

Investment involves risks, the value of investments and the income from them may fluctuate in accordance

with market conditions and taxation agreements and investors may not get back the full amount invested.

Both past performance and yields are not a reliable indicator of current and future results.