Asset Allocation – the base case for Corporate Bonds?

In Australia, with many investments making up portfolios in Self Managed Super Funds (SMSF) it is critical to get a good mix of investments.

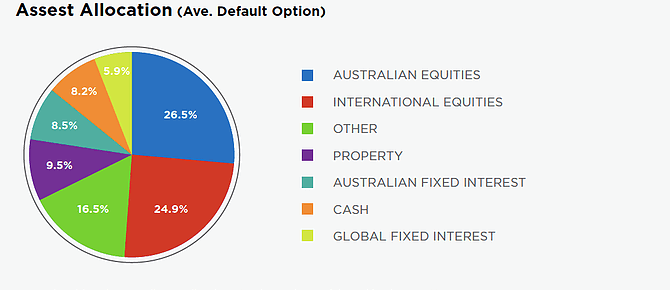

Have you every considered what should make up a well-balanced portfolio of investments. In Australia, with many investments making up portfolios in Self Managed Super Funds (SMSF) it is critical to get a good mix of investments. Why? It is simply to achieve sustainable growth and to diversify risks. If you are setting up your own SMSF and acting as the trustee, then understanding what a good portfolio looks like just means your retirement is safe guarded. There is plenty of information required to make informed investment decisions it is up to you to do your own research. Managing it yourself does give you the ultimate flexibility to back your investment decisions, to invest in areas you have knowledge in…plus of course you are not paying a fund manager or financial planner One aspect that fund managers and financial planners do well is to allocate assets across a range of different markets. In fact the average default mix, as offered by Australian super funds, looks like the below pie chart:

Most new SMSF on setting up an Fund head out and buy their favorite shares, maybe a residential or commercial property, put a bit of cash in TDs/at-call, and maybe even put some equity in to a private firm. But what about that 14.4% fixed interest component? What’s amazing is that so many people, even when it appears on their fund’s portfolio report, really have no idea what that ‘fixed interest’ piece of pie represents, and so often it is left out of an SMSF portfolio! In fact, across the entire $1bn value of SMSFs in Australia, less than 3% is in fixed interest! This is the lowest percentage in the OECD…by some margin.

What is fixed interest (or fixed income) anyway?

A fixed income security is an investment that provides a return in the form of periodic payments and the eventual return of principal at maturity. This is essentially bonds and hybrids. Companies and governments issue debt in these forms, as a way to raise capital. If a business wants money, they can issue shares, they can go to the bank, or they can issue a bond or hybrid. These are legal debt obligations, and any failure to repay principal or interest as part of the arrangement, constitutes a default. Because fixed income ranks above ordinary shares, in that unlikely default scenario, bondholders must be paid out before shareholders can see a penny.

What are different types of fixed income products?

Fixed income covers all bonds and hybrids. That range is enormous – with the global bond market being four times the size of the global share market. Risk and return can be as low as a federal government bond @ say 3%pa, or as high as a speculative corporate bonds@ 18%pa! Interest payments can be set as a fixed rate, a floating rate over BBSW/LIBOR, or indexed with inflation. So if you have a particular view on rates and growth, you can assert that view on your fixed income investments. That is: Rising rates = Buy floaters. Falling rates = Lock in a fixed rate. Inflation fears = Buy index-linked.

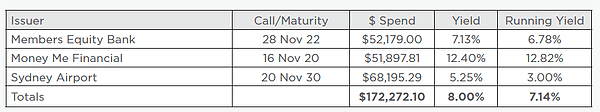

For example with a combined annual income of 7.14%pa, and an overall yield to maturity of 8.00%pa, below are three fixed income investments that may make up part of an investment involving fixed income. This investment will add stability and income to any current investment portfolio:

Why is fixed income in Australia so far behind the rest of the developed economies?

It’s really to do with access. Up until a decade ago, in Australia, bonds only traded in $500,000 parcels. Overseas, (eg. USA) bonds can be bought and sold in denominations as small as $1000. So that large investment size here has made it impossible for the large majority of private investors to access. That has since changed, and now these products can be bought and sold in $50,000 parcels, or even smaller on the ASX.

The other factor that has stunted the growth of fixed income in Australia is knowing where and how to trade them? The overwhelming majority of fixed income products trade in an ‘over-the-counter’ (OTC) market, which is a negotiated marketplace with multiple participants. This is not unlike currency, or real estate, in that there is no specific exchange. It is therefore important to have a good broker that can assist in organizing offers and bids for you to be able to transact on. That being said, there are now a number of fixed income products trading on the ASX, and we expect this to continue to grow. There, you can buy and sell bonds and hybrids with as little as $100 in your pocket! This expansion on to the listed market can only help bring exposure, and transparency to our asset class.

Its important to have a Broker that has a wealth of knowledge to help.

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818

AFSL 338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively

as “Probis Group”). It is a general communication being provided for informational purposes only. It is

educational in nature and not designed to be taken as advice or a recommendation for any specific

investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment

from Probis Group to participate in any of the transactions mentioned herein.

Probis Group provides general financial product advice only. As a result, this communication, and any

information, has been provided by Probis Group without taking account of your objectives, financial

situation and needs. Probis Group’s Australian Financial Services Licences do not authorise it to

provide personal advice.

Before acting on any information in this communication, you should consider the appropriateness of it

(and any relevant product) having regard to your circumstances and, if a current offer document is

available, read the offer document before acquiring products named in this communication. You should

also seek independent financial, legal and taxation advice if any investment mentioned herein is

believed to be suitable to your personal goals.

Investors should ensure that they obtain all available relevant information before making any

investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for

information purposes only, based on certain assumptions and current market conditions and are subject to

change without prior notice. Any examples used are generic, hypothetical and for illustration purposes

only.

Probis Group believes that the information contained in this communication is correct and that any

estimates, opinions or conclusions are reasonably held or made as at the time of compilation. However,

no warranty is made as to the accuracy or reliability of this information (which may change without

notice). Probis Group relies on third parties to provide certain information and is not responsible for

its accuracy, nor is Probis Group liable for any loss arising from a person relying on information

provided by third parties.

Investment involves risks, the value of investments and the income from them may fluctuate in accordance

with market conditions and taxation agreements and investors may not get back the full amount invested.

Both past performance and yields are not a reliable indicator of current and future results.