Understanding Bond Market Prices

In the market, bond price quotation is based on the percent of the bond’s face value. The face value is equal to a bond’s price when it is first issued.

When trading in the corporate bond market, it is critical to have a good understanding of the drivers behind bond prices. As not understanding how this works could mean the difference between a good and bad performing portfolio. Further, a good understanding will also provide the basis for investing in corporate bonds that may be mispriced. Bonds are issued by corporates as a means to raise capital, they can be bought and sold in the secondary market via the OTC market, or the Australian Securities Exchange (ASX). The makeup of all bond prices is the same. So it’s essential to get a good handle on this. Below we have outlined some of the important aspects when considering bonds from a pricing perspective.

After a bond is issued by a corporate, it can be bought and sold in the secondary markets. Its value is determined by the sentiment for the bond, its coupon/interest payment and time to expiry. The yield rate is the actual annual return an investor can expect per year if the bond was held to maturity. Therefore, the yield is based on the purchase price of the bond as well as the coupon.

In the market, the bond price quotation is based on the percent of the bond's face value. The face value, or par value, is equal to a bond’s price when it is first issued. For example, if the bond trades at $100, every $1000 face value of the bond will cost $1000, in this case, it is trading at “par”.

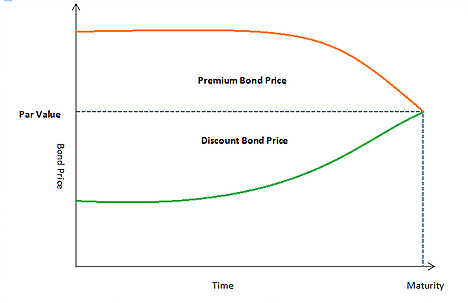

Likewise, if a bond is quoted at $99 in the market, the price is $990 for every $1,000 of face value this particular bond is trading at a discount. On the other hand, if the bond is trading at $101, it costs $1,010 for every $1,000 of face value, this bond is said to be trading at a premium. Bonds are issued at par then trade to a value in the secondary market. This price could be slightly below par or above depending on the coupon, the credit rating of the bond and importantly how the market perceives the company and its ability to perform.

The graph of par value, discount price and the premium price shown as follows:

The bond price always reacts in the opposite direction to its yield. The bond price reflects the

value of sentiment the market has for it plus the income that is earned via regular coupon/interest

payments from the corporate. When the current interest rate falls, for example, older bonds of all

types become more valuable. The reason for this is that these bonds were sold to investors in a

higher interest rate environment, which leads to receiving a higher coupon.

Investors holding

older bonds can charge a “premium “ to sell them in the secondary market, a capital gain, as other

investors seek them out looking for higher returns. Hence, better market sentiment. On the other

hand, if the interest rates rise, the older bonds may become less valuable because their coupons are

relatively low and the older bonds, then, trade at a “discount”.

When investors are considering that interest rates are rising, new bonds will pay investors higher interest rates than the older ones, so the old bonds tend to drop in price, which could reflect in a capital loss. If the interest rates are falling it means the older bonds are paying higher interest rates than new bonds; the older bonds then tend to sell at a premium in the market and you could experience capital gains. These losses or gains are independent of the coupon that is paid..

In summary, when looking at making investment decisions into corporate bonds, it is always important to understand how the pricing of the bond/return on your portfolio is affected by investment conditions. Ask yourself questions like; what are interest rates doing? How does the market perceive the bond? Should my portfolio be weighted to long-dated or short-dated bonds? Or directly ask your Probis Securities Dealer for generic advice on the topic.

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818

AFSL 338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively

as “Probis Group”). It is a general communication being provided for informational purposes only. It is

educational in nature and not designed to be taken as advice or a recommendation for any specific

investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment

from Probis Group to participate in any of the transactions mentioned herein.

Probis Group provides general financial product advice only. As a result, this communication, and any

information, has been provided by Probis Group without taking account of your objectives, financial

situation and needs. Probis Group’s Australian Financial Services Licences do not authorise it to

provide personal advice.

Before acting on any information in this communication, you should consider the appropriateness of it

(and any relevant product) having regard to your circumstances and, if a current offer document is

available, read the offer document before acquiring products named in this communication. You should

also seek independent financial, legal and taxation advice if any investment mentioned herein is

believed to be suitable to your personal goals.

Investors should ensure that they obtain all available relevant information before making any

investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for

information purposes only, based on certain assumptions and current market conditions and are subject to

change without prior notice. Any examples used are generic, hypothetical and for illustration purposes

only.

Probis Group believes that the information contained in this communication is correct and that any

estimates, opinions or conclusions are reasonably held or made as at the time of compilation. However,

no warranty is made as to the accuracy or reliability of this information (which may change without

notice). Probis Group relies on third parties to provide certain information and is not responsible for

its accuracy, nor is Probis Group liable for any loss arising from a person relying on information

provided by third parties.

Investment involves risks, the value of investments and the income from them may fluctuate in accordance

with market conditions and taxation agreements and investors may not get back the full amount invested.

Both past performance and yields are not a reliable indicator of current and future results.