Why Invest in Corporate Bonds?

Having a corporate bond portfolio in your overall investment strategy looks to preserve your capital, provide for capital growth, offer good income streams and finally looks to reduce the volatility associated with other investments.

Corporates issue bonds as a way of raising funds to finance projects. They borrow funds from investors making it a form of debt that the corporate has to pay back. When you purchase a bond, the bond issuer is legally obliged to pay you regular interest (coupons), and at the bond’s maturity, the face value of the bond must be returned to you.

Corporates also issue bonds to help diversify their borrowing methods, which in turn helps to provide investment opportunities for investors. There are various types of bonds available that also have various maturities that can suit most investment portfolios. So it is important to have a good understanding of these and also a good Broker that can advise you accordingly. A good investment portfolio should consist of equities (shares), term deposits, corporate bonds (fixed income) and property. Corporate bonds, equities and term deposits are complementary investments and should be combined to offer stable returns. Overall, corporate bonds offer a better return than cash and a better more sustainable income stream than equities. Plus, the income stream is more predictable.

Investing in corporate bonds that have good credit rating helps to preserve capital. Why?

Firstly, when you invest in a corporate bond and the corporate has difficulty in meeting its obligations. You rank equally with the banks and will have priority over equity or hybrid investors when the proceeds of asset sales are applied. If you held a share that share may become worthless if the company went into liquidation.

Secondly, although both corporate bonds and term deposits have good capital preservation qualities the returns on term deposits are traditionally very low corporate bonds could provide returns as high as 12% whilst term deposits traditionally lie well below this currently between 1-2% further. Further term deposits cannot be sold in secondary market and do not have the potential for capital appreciation like bonds do.

Should I invest in the corporate bond market?

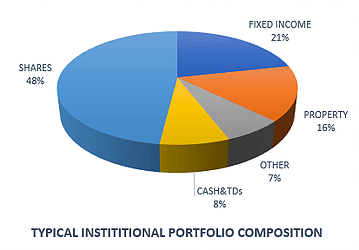

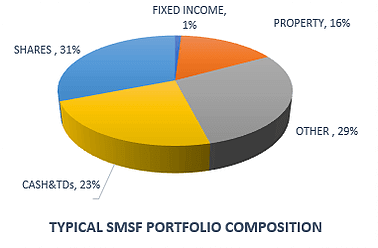

Currently, 29% of investments made by major pension funds in the top seven countries are allocated to corporate bonds. The typical institutional based portfolio built by fund manager has 22% allocated in bonds to offset diversification risk. In Australia, the investment percentage is significantly lower but growing. For instance, of the financial instruments that SMSFs can invest in 31% are allocated to listed shares/equities, 23% remains in cash and term deposits, and only 1% of their assets are allocated to corporate bonds. This allocation is slowly changing as investors start to understand the importance of diversifying their investments. One of the main reasons for this was that up until 2010, corporate bonds were only available in parcels of $500,000, limiting access to this market. But this is not the case anymore, anyone can invest in Bonds through our company.

While the value of bonds won’t go up (or down) as much as when compared to a shares or property they help to present stable income and reduce the volatility in your investment portfolio. For instance for a company like Qantas it has shares and bonds. When they post good results, the share price will go up and so to does the value of their bond but not as much. Similar if the share price goes down so to may the bond price, but then again not as much. Like shares investors can also trade corporate bonds for capital gain.

To sum up, why choose a corporate bond?

Simple having a corporate bond portfolio in your overall investment strategy looks to preserve your capital, provide for capital growth, offer good income streams and finally looks to reduce the volatility associated with other investments.

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818

AFSL 338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively

as “Probis Group”). It is a general communication being provided for informational purposes only. It is

educational in nature and not designed to be taken as advice or a recommendation for any specific

investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment

from Probis Group to participate in any of the transactions mentioned herein.

Probis Group provides general financial product advice only. As a result, this communication, and any

information, has been provided by Probis Group without taking account of your objectives, financial

situation and needs. Probis Group’s Australian Financial Services Licences do not authorise it to

provide personal advice.

Before acting on any information in this communication, you should consider the appropriateness of it

(and any relevant product) having regard to your circumstances and, if a current offer document is

available, read the offer document before acquiring products named in this communication. You should

also seek independent financial, legal and taxation advice if any investment mentioned herein is

believed to be suitable to your personal goals.

Investors should ensure that they obtain all available relevant information before making any

investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for

information purposes only, based on certain assumptions and current market conditions and are subject to

change without prior notice. Any examples used are generic, hypothetical and for illustration purposes

only.

Probis Group believes that the information contained in this communication is correct and that any

estimates, opinions or conclusions are reasonably held or made as at the time of compilation. However,

no warranty is made as to the accuracy or reliability of this information (which may change without

notice). Probis Group relies on third parties to provide certain information and is not responsible for

its accuracy, nor is Probis Group liable for any loss arising from a person relying on information

provided by third parties.

Investment involves risks, the value of investments and the income from them may fluctuate in accordance

with market conditions and taxation agreements and investors may not get back the full amount invested.

Both past performance and yields are not a reliable indicator of current and future results.