Investing in Bonds

Bond investments are known to be generally stable, low-to-medium risk investments that pay a defined rate of return for a known period of time.

Bonds are issued by the ‘bond issuer’ who will borrow from investors known as ‘bond holders’. Once a bond has

been issued in the primary market, it can then be bought and sold in a secondary market.

Unlike most shares which are listed and trade via an exchange, most bonds trade via the over-the- counter

(OTC) market. Participants who wish to buy and sell bonds directly via the OTC market must be set up to do so,

including having their own settlement facilities and custodial service for the holding of bond

investments.

For self-directed investors this usually requires a bond investment broker to offer the above services which

allow for the buying, selling and holding of direct bond investments.

Common Issuers of Bond Investments

- Governments

- Banks and financial institutions

- Companies (corporates)

Bond Terminology

Yield

The per annum rate of return an investor will receive over the life of the bond investment

Coupon

The interest payment received from the bond investment. The coupon is normally paid either semi-annually (every 6 months) or quarterly (every 3 months). For example, a bond with a fixed coupon of 5% will pay $2.5 semi-annually per $100 face value

Face Value

The face value is the nominal or dollar value of a bond investment. The face value is the amount that must be repaid to the bond holder at maturity. For example, a bond holder who holds $100,000 face value will receive $100,000 payment when the bond investment matures

Maturity

The date on which a bond investment matures and the face value is repaid to the holder of the bond

Call Date

The date on which a bond issuer can opt to repay a bond. Call dates provide the bond issuer flexibility as to when a bond can be repaid. Usually bond issuers will “call” a bond at the first opportunity

Issue Price

The price at which a bond is issued to the market. Usually bonds are issued at a price of $100

Capital Price

The current market price of a bond excluding the interest that has accrued since the last coupon payment; also known as a Clean Price

Gross Price

The current market price of a bond including the interest that has accrued since the last coupon payment; also known as a Dirty Price

Capital Value

The value of capital based on a bond holder’s face value investment and the Capital Price of the bond. For example, a $100,000 face value of a bond priced at $103 capital price gives a capital value of $103,000

BBSW

BBSW stands for Bank Bill Swap Rate, which is the benchmark reference rate used to price floating rate bonds. Floating rate bonds pay a fixed margin above the BBSW, which is measured on a daily basis and fluctuates with changes in short-term interest rate expectations

Running Yield

Running yield is a measure of the annual income return that a bond investment generates. It is calculated by dividing the coupon payment % against the capital price of the bond. For example, a bond with a 6% coupon trading at a capital price of 103 has a running yield of 5.825% (6% / 1.03). The running yield tells the bond holder that the bond will generate 5.825% income p.a. per $103 capital invested

Credit Rating

A measure of bond investment risk provided by independent ratings agencies. The main ratings agencies are Standard and Poor’s (S&P), Moody’s and Fitch. A credit rating takes into account the general financial health of a bond issuer, ability to make interest and principal payments when due and likelihood of recovery in an event of default

Capital structure

The of funding used by companies to finance their operations. Companies Structure will issue debt, equity (shares) or a mixture of both (hybrids) for the purpose of raising then using capital. The rank of seniority in the capital structure determines the priority of payment in a wind-up scenario. Typically, debt or bonds will be paid out first, followed by hybrids and then lastly equity

- Senior Secured Debt

- enior Unsecured Debt Tier 2 Capital

- Tier 1 Capital

- Equity

Main types of Bonds

Fixed Coupon Bonds

Fixed coupon bonds pay a fixed rate of return per annum based on a “yield” to maturity. The yield takes into account the coupon or interest payment on the bond, as well as any capital gain or loss to be realised over the life of the investment. Yield to maturity is calculated in Australia using a standardised formula from the Reserve Bank of Australia.

Fixed coupon bonds that are purchased at first instance in the primary market and issued at $100 will pay the same yield to maturity as the coupon rate. Bonds that are priced below $100 are said to be trading at a “discount” to face value and bonds priced above $100 are said to be trading at a“premium” to face value.

Example 1 – Asciano 5.40% 12 May 2027 bond

This bond issued by Asciano Ltd is a 10-year bond which pays a fixed coupon of 5.40%. An investor who bought $100,000 face value of this bond in the primary market will receive a semi-annual couponof $2,700 on both 7th July and 7th January each year. This will give the investor $5,400 interest payments per annum and a return of 5.40% on their $100,000 investment for each year of the 10-year term.

Example 2 – Telstra 4.00% 16 September 2022 bond

This bond was issued by Telstra Ltd in 2015 for a period of 7 years with a fixed coupon of 4.00%. The bond is currently trading in the secondary market at a capital price of 103.784 and a gross price of and will mature in just over 5 years’ time. An investor who wants to buy $100,000 face value of this bond will need to invest $105,154 and will receive a semi-annual coupon of $2,000 on both the 16th March and 16th September each year. The investor will then be repaid the $100,000 face value at maturity. Taking into account the $2,000 semi-annual coupon payments between now and maturity (11 payments left totalling $22,000) as well as the $5,154 capital loss at maturity, investors will earn a yield of 3.19% p.a.

Floating Rate Notes (FRNs)

FRNs pay a floating rate of return per annum based on an expected yield to maturity. This return is forecast based on the benchmark reference rate known as the Bank Bill Swap Rate (BBSW). BBSW changes on a daily basis and is a forecast of market interest rates over a set period of time. A floating rate note pays a fixed coupon above the BBSW and normally pays a quarterly interest payment which resets every 90 days. Due to these resets, the coupon payment for FRNs will go up and down with changes in short-term interest rate expectations. The yield to maturity is forecast based on theexpected interest rate changes over the life of the FRN.

Example – Heartland Bank +4.15% 7 April 2022 call, 7 April 2027 maturity

This FRN was issued on 7th April 2017 with a 5 year call date and a 10 year maturity date. The market expects this FRN to be called at the 5 year call date. This FRN was issued with a fixed coupon of 4.15% above the floating BBSW, which at the time of issue was forecasting an average interest rate benchmark of 2.55% over the 5 year term. This gave an expected return at issue of 6.70% p.a. (4.15% + 2.55%).

Inflation Linked Bonds

Inflation linked bonds or ILBs pay a fixed yield p.a. to maturity on top of the headline Consumer Price Index (CPI) inflation readings. ILBs pay quarterly coupons which adjust with the quarterly CPIreadings. There are two types of ILBs:

1.Capital Indexed Bonds

Capital indexed bonds adjust the capital value of a bond with changes in CPI. This “indexation” continues until the bond matures, at which time the bond holder receives the inflation adjusted capital value of the original face value of the bond. The coupon payment on the bond is fixed and is based on the CPI adjusted capital value of the bond. For example a capital indexed bond with a coupon of 4% with an original face value of $100,000 and initial capital value of $100,000 will adjust upwards with 2% annual CPI to $102,000 capital value over one year. The 4% coupon is then paid on this higher $102,000 capital value.

2.Inflation Indexed Annuity Bond

Indexed annuity bonds pay a CPI linked annuity revenue stream. Unlike nominal fixed and floating rate bonds,

which pay a coupon payment and then return face value to the holder at maturity, annuity bonds repay holders a

quarterly income stream over the life of the investment, which includes a coupon payment as well as a partial

return of face value.

A common example of an annuity type investment is a typical residential mortgage, where borrowers repay the

bank periodic payments of both principal and interest equating to an annual rate of interest.

Indexed Annuity Bonds pay an inflation adjusted return to the bond holder, via an annuity revenue stream

similar to a typical residential mortgage. The return paid to bond holders above inflation is known as the

“real yield”. Where mortgage borrowers normally pay the same repayment amounteach period, an Indexed Annuity

Bond will pay a higher repayment amount each quarter as inflation rises.

Example – Royal Womens Hospital 2033 Inflation Indexed Annuity Bond

This inflation indexed annuity bond pays a real yield of 3.30% between now and its maturity in 2033. This

means that the holder will be paid a return of 3.30% + inflation over the life of the bond. If inflation

averages 2.50% over the next 16 years, the holder will receive a 5.80% total return. This return will be paid

quarterly via cash flows that repay both principal and interest with each payment. By 2033, the bond holder

will have received all interest and face value of their investment, equating to a return of 5.80% p.a.

Comparing Bonds and Relative Value

When looking at relative bond investments, bond investors will compare amongst other things:

Yield

What yield does Bond A return p.a. in comparison to Bond B?

Running Yield

What is the comparative annual income return?

Maturity

What is the maturity of Bond A vs Bond B?

Credit Rating

What is the comparative level of risk between Bond A and Bond B?

Captial Structure

Where do Bonds A and B sit in the capital structure of the issuer?

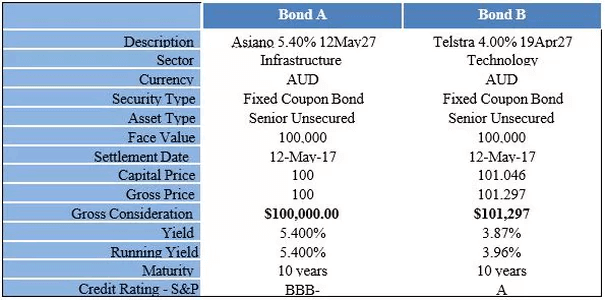

Example – Asciano 5.40% 12 May 2027 bond vs Telstra 4.00% 19 April 2027 bond

In the above example, Asciano yields 5.40% p.a. vs Telstra which yields 3.87% p.a. Asciano therefore pays an

additional return p.a. of 1.53%.

Telstra, which pays a 4% coupon is trading at a capital price of 101.046, which gives a 3.96% p.a. running

yield. This is 1.44% income p.a. less than Asciano which has a running yield of 5.40%.

Asciano and Telstra have almost the same maturity. However the Telstra bond is an A rated bond, which is a

lower risk bond investment than the Asciano BBB- rated bond. Both bonds sit at the same level in the company

capital structure.

IMPORTANT INFORMATION

This communication is provided by Probis Financial Services Limited ABN 45 134 959 818 AFSL

338241 and Probis Securities Pty Limited ABN 81 149 475 105 AFSL 403070 (referred to collectively as “Probis

Group”). It is a general communication being provided for informational purposes only. It is educational in

nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy,

plan feature or other purpose in any jurisdiction, nor is it a commitment from Probis Group to participate in

any of the transactions mentioned herein.

Probis Group provides general financial product advice only. As a result, this communication, and any

information, has been provided by Probis Group without taking account of your objectives, financial situation

and needs. Probis Group’s Australian Financial Services Licences do not authorise it to provide personal

advice.

Before acting on any information in this communication, you should consider the appropriateness of it (and any

relevant product) having regard to your circumstances and, if a current offer document is available, read the

offer document before acquiring products named in this communication. You should also seek independent

financial, legal and taxation advice if any investment mentioned herein is believed to be suitable to your

personal goals.

Investors should ensure that they obtain all available relevant information before making any investment. Any

forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only,

based on certain assumptions and current market conditions and are subject to change without prior notice. Any

examples used are generic, hypothetical and for illustration purposes only.

Probis Group believes that the information contained in this communication is correct and that any estimates,

opinions or conclusions are reasonably held or made as at the time of compilation. However, no warranty is made

as to the accuracy or reliability of this information (which may change without notice). Probis Group relies on

third parties to provide certain information and is not responsible for its accuracy, nor is Probis Group liable

for any loss arising from a person relying on information provided by third parties.

Investment involves risks, the value of investments and the income from them may fluctuate in accordance with

market conditions and taxation agreements and investors may not get back the full amount invested. Both past

performance and yields are not a reliable indicator of current and future results.